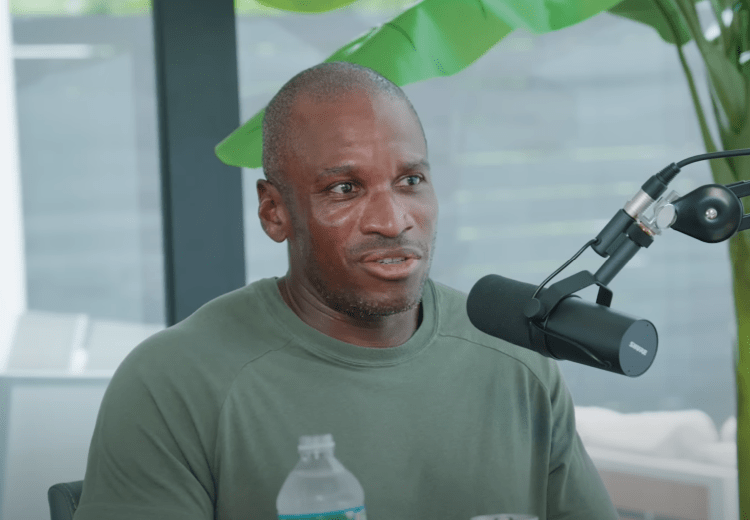

Arthur Hayes has published a new essay, “Quid Pro Stablecoin,” arguing that the United States’ sudden political enthusiasm for bank-issued stablecoins is less about “financial freedom” and more about arming the Treasury with a multi-trillion-dollar “liquidity bazooka.” The former BitMEX chief—writing in his personal newsletter—contends that investors who postpone buying Bitcoin until the Federal Reserve resumes quantitative easing will serve as “exit liquidity” for those who bought earlier. How The Money Printer Is Already Warming Up At the core of Hayes’ thesis is the claim that eight “too-big-to-fail” banks hold roughly $6.8 trillion in demand and time deposits that can be transformed into on-chain dollars. Once customers migrate from legacy accounts to bank stablecoins—he cites JPMorgan’s forthcoming “JPMD” token as the template—those deposits become collateral that can be recycled into Treasury bills. “Adoption of stablecoins by TBTF banks creates up to $6.8 trillion of T-bill buying power,” he writes, adding that the product simultaneously slashes compliance overhead because “an AI agent trained on the corpus of relevant compliance regulations can perfectly ensure that certain transactions are never approved.” Hayes layers a second mechanism on top of the stablecoin flow. If Congress strips the Federal Reserve of its ability to pay interest on reserve balances—a proposal floated by Senator Ted Cruz—banks would have to replace that lost income by buying short-dated Treasuries. He estimates the policy could “liberate another $3.3 trillion of inert reserves,” bringing the prospective fire-power for government debt purchases to $10.1 trillion. “This $10.1 trillion liquidity injection will act upon risky assets in the same way Bad Gurl Yellen’s $2.5 trillion injection did… PUMP UP THE JAM!” Hayes asserts. The essay frames the bipartisan GENIUS Act as the legislative linchpin. By barring non-banks from issuing interest-bearing stablecoins, Washington “hands the stablecoin market to banks,” ensuring that fintech issuers such as Circle cannot compete at scale and that deposit flight is funneled into the institutions most likely to bankroll the Treasury. Hayes calculates that the cost savings and enhanced net-interest margins could increase the combined market capitalisation of the big banks by more than 180 percent, a trade he describes as “non-consensus” but executable “in SIZE.” Buy Bitcoin Before The Fed Blinks Despite his long-term enthusiasm, Hayes cautions that a temporary liquidity drain looms once Congress passes what he labels Trump’s “Big Beautiful Bill.” Refilling the Treasury General Account to its $850 billion target could contract dollar liquidity by nearly half a trillion dollars, an impulse he believes may knock Bitcoin back toward the mid-$90,000s and keep prices range-bound until the Federal Reserve’s annual Jackson Hole conference in late August. ?Arthur Hayes has published a new essay, “Quid Pro Stablecoin,” arguing that the United States’ sudden political enthusiasm for bank-issued stablecoins is less about “financial freedom” and more about arming the Treasury with a multi-trillion-dollar “liquidity bazooka.” The former BitMEX chief—writing in his personal newsletter—contends that investors who postpone buying Bitcoin until the Federal Reserve resumes quantitative easing will serve as “exit liquidity” for those who bought earlier. How The Money Printer Is Already Warming Up At the core of Hayes’ thesis is the claim that eight “too-big-to-fail” banks hold roughly $6.8 trillion in demand and time deposits that can be transformed into on-chain dollars. Once customers migrate from legacy accounts to bank stablecoins—he cites JPMorgan’s forthcoming “JPMD” token as the template—those deposits become collateral that can be recycled into Treasury bills. “Adoption of stablecoins by TBTF banks creates up to $6.8 trillion of T-bill buying power,” he writes, adding that the product simultaneously slashes compliance overhead because “an AI agent trained on the corpus of relevant compliance regulations can perfectly ensure that certain transactions are never approved.” Hayes layers a second mechanism on top of the stablecoin flow. If Congress strips the Federal Reserve of its ability to pay interest on reserve balances—a proposal floated by Senator Ted Cruz—banks would have to replace that lost income by buying short-dated Treasuries. He estimates the policy could “liberate another $3.3 trillion of inert reserves,” bringing the prospective fire-power for government debt purchases to $10.1 trillion. “This $10.1 trillion liquidity injection will act upon risky assets in the same way Bad Gurl Yellen’s $2.5 trillion injection did… PUMP UP THE JAM!” Hayes asserts. The essay frames the bipartisan GENIUS Act as the legislative linchpin. By barring non-banks from issuing interest-bearing stablecoins, Washington “hands the stablecoin market to banks,” ensuring that fintech issuers such as Circle cannot compete at scale and that deposit flight is funneled into the institutions most likely to bankroll the Treasury. Hayes calculates that the cost savings and enhanced net-interest margins could increase the combined market capitalisation of the big banks by more than 180 percent, a trade he describes as “non-consensus” but executable “in SIZE.” Buy Bitcoin Before The Fed Blinks Despite his long-term enthusiasm, Hayes cautions that a temporary liquidity drain looms once Congress passes what he labels Trump’s “Big Beautiful Bill.” Refilling the Treasury General Account to its $850 billion target could contract dollar liquidity by nearly half a trillion dollars, an impulse he believes may knock Bitcoin back toward the mid-$90,000s and keep prices range-bound until the Federal Reserve’s annual Jackson Hole conference in late August. ?

1